Private Equity in Developing Countries 小丸子 小新 PresentBy

WHYHOWWHATof1

LoadingWHYPrivate EquityDeveloping CountriesChina&India123of2

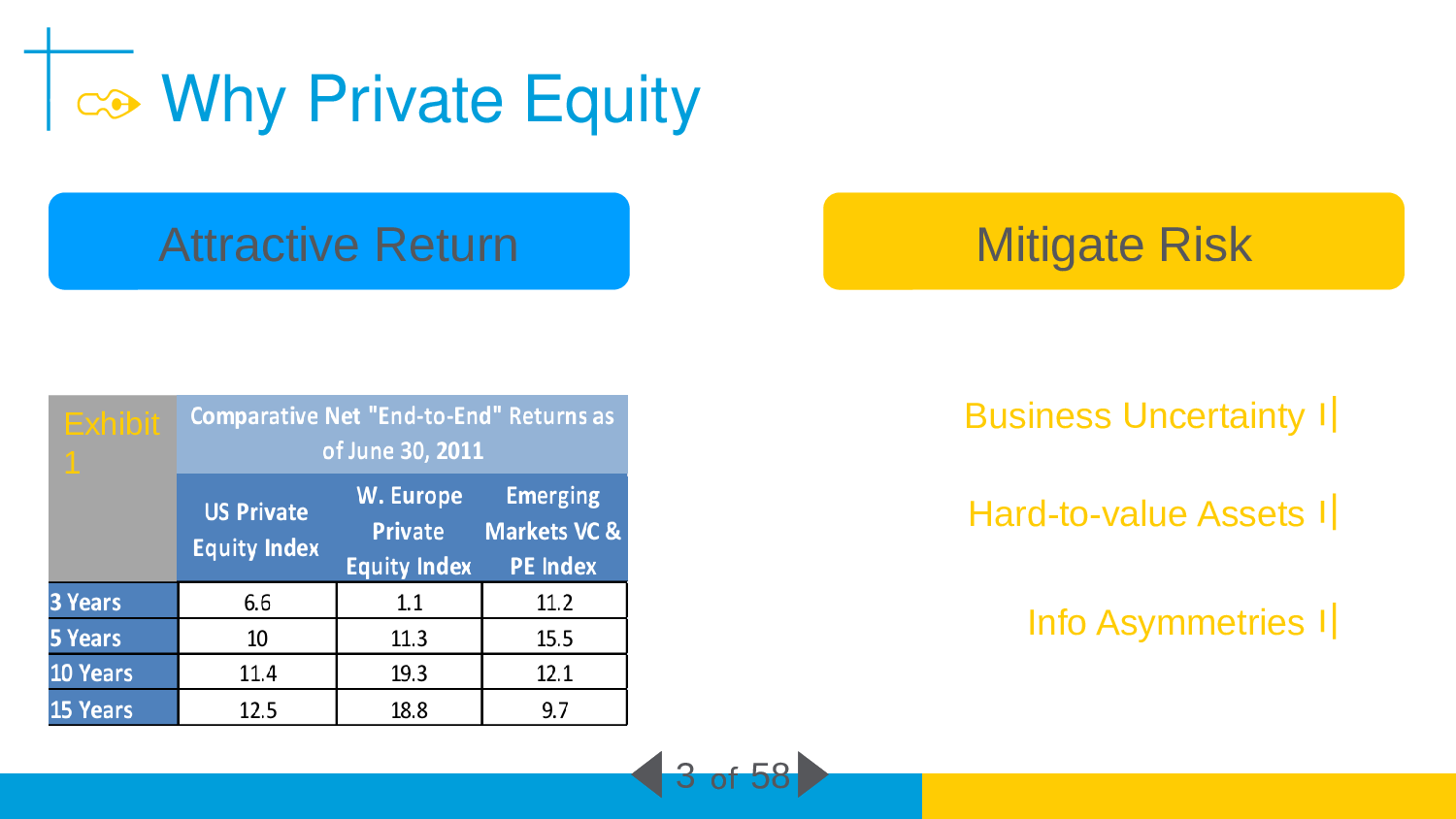

Why Private EquityAttractive ReturnMitigate RiskBusiness UncertaintyHard-to-value AssetsInfo Asymmetriesof13Exhibit 1

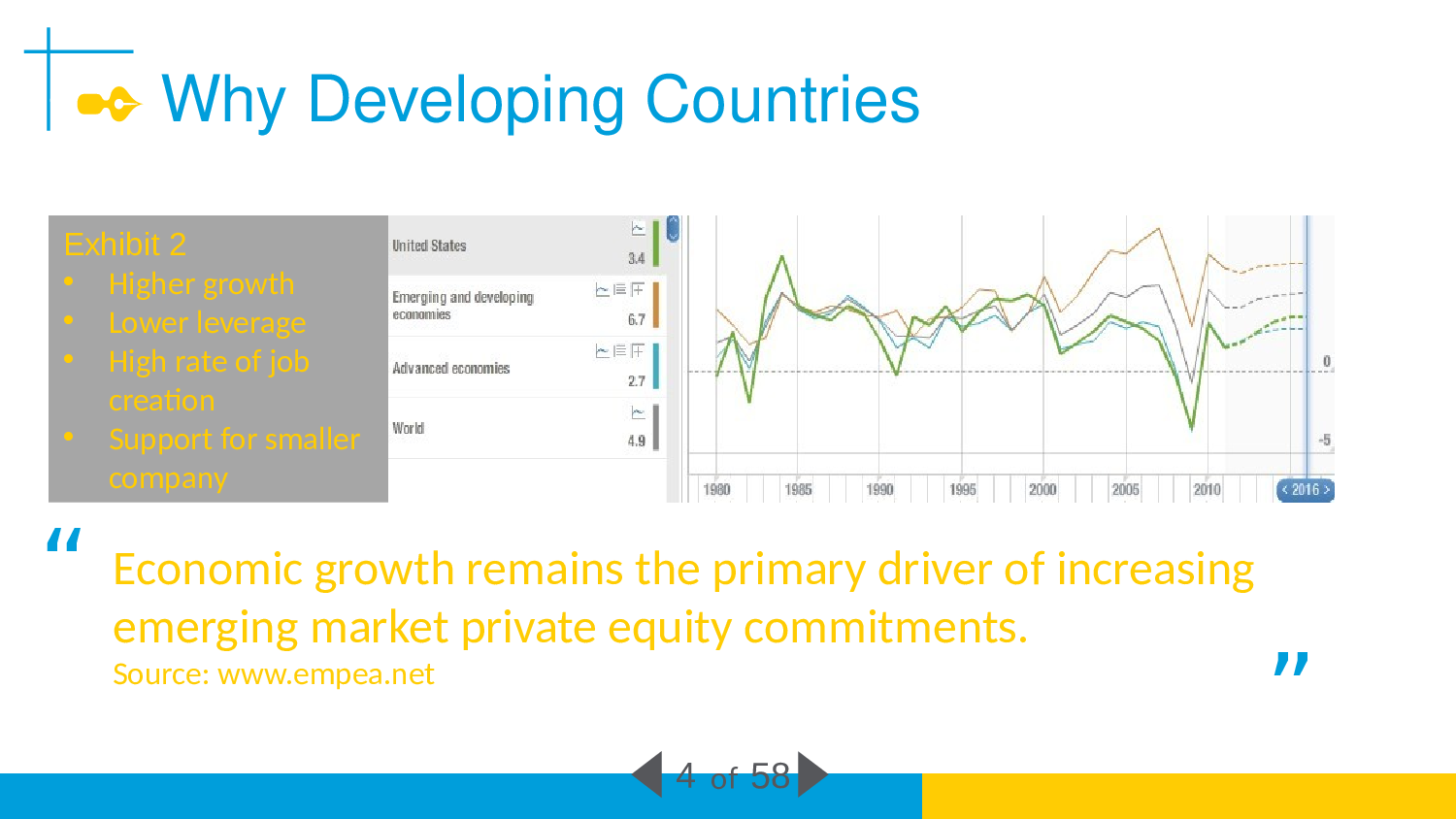

Why Developing Countries“Economic growth remains the primary driver of increasing emerging market private equity commitments. Source: www.empea.net”2Exhibit 2Higher growthLower leverageHigh rate of job creation Support for smaller company4

Why Developing CountriesEU 36% 26% Asia/Oceania 27%15% 2Exhibit 3For 2010 & 2011, Asia/Oceania's share is higher than both the EU15 and the USA5

Why Developing CountriesEmerging markets increaseUS one of countries that declined fastest2Exhibit 4 & 5The index measures: size of gov, expenditures, taxes, enterprises, legal structure and security of property rights, access to sound money freedom to trade internationally regulation of credit, labor, and business6

Why Developing CountriesExhibit 6 & 7Both the Breadth and the Quality of the Emerging Market Private Equity Opportunity have Improved Since 2000.27

Why Developing CountriesAttractiveness of Developing CountriesEconomic ProgressEconomic ReformPlanned Capitalist1989 Brady PlanRestructure external debtBoost economic healthIncrease investor confidenceTax ReformLower tax on capital gainsRelax Restriction of Foreign InvestmentEncourage equity investment & stock market growthImprove Accounting & Disclosure StandardsLower investing costsDiminish info asymmetriesof28

Why China&IndiaEmerging Asian markets NO.1 attractive destinations for global investorsChina No.1 investment target for 9 consecutive yearsIndia No.2 investment targetRising Middle ClassUrban MigrationIncreasing Market Demand310

Why China & India3111980sForeign direct investment allowed: 4 economic zones (1990 every city)19901st stock exchange2001Join WTO20042nd board for SMEs—liquidity for 29.3m SMEs(contributes 75% workforce, 51% GDP 2004Legalized the ownership of private property gave corporation an infinite life2006Bankruptcy law—framework of bankruptcy in private and state-owned enterprises, clear procedures for insolvent enterprise to restructure or exit allotment option on IPOs, one year lockup

LoadingHOWFundraisingInvestingExiting12314

How Fundraising – Fund StructureLimited liability partnership Under the old Partnership Law, only unlimited liability partnerships were permissible.Legal person partners The amended Partnership Law allows both legal persons and individuals to invest in partnerships119

How Fundraising – Capital SourceInstitutional InvestorsWith the exception of investments targeted towards infrastructure, regulations don’t permit conventional sources of PE capital like insurance companies and pension funds in India to participate in PE.Domestic PE firms are limited to raising fund from non-financial institutions.Individual InvestorsDomestic PE firms are limited to raising fund from affluent individual investors.121

How Fundraising – Capital SourceNew PE player in developing countryUS foreign aid (eg., USAID), UN, World Bank, IIC, CDCGov. investment arm: EBRD, DEG, FMO, Norfund, Quasi gov corp. (eg. OPIC)Multilateral financial institutions (eg.IFC)2 fold roleInvest in Funds as direct grant/LT loanProvide guarantee122

How Fundraising – Capital SourceWhy Local Based Fund languagelocal networksexperience at top US-based institution124For any of the large private-equity firms in the West to be a real player in China, you probably should have a RMB-dominated fund. “”-- David Rubenstein

How Investing: Types of Investment227

How Investing: Types of InvestmentPrivatizationsImprove the productivity of SOE (<< private firms)Access investment capital &Improve service deliveryReduce the fiscal burden of loss-making firms229

How Investing: Types of InvestmentPrivatizations-- Developing Countries2Exhibit 13Privatization in developing countries.30

How Investing:

可编辑套装+内容:发展中国家的私募基金.pptx